Corporate Property Insurance

Whom is

Corporate

Property

Insurance for?

Why it is useful to insure with us?

Why it is useful to insure with us?

What do we

cover with

Corporate

Property

Insurance?

You can choose additional insurance services

If you are interested in additional services, consult our experts and we will help you choose the right one

When an insured event occurs, such as a fire, a company often incurs losses not only from damaged or destroyed property but also from interrupted or suspended business operations—such as the inability to provide services, a declining market share, and fixed costs (like employee salaries, interest, etc.). Losses due to business interruption are compensated from working capital, which eventually runs out. The company’s operations then come to a halt.

Even if a company has insured its property, financial losses due to business interruption are covered only if they are insured with business interruption insurance.

The greatest benefit of business interruption insurance is that it ensures the financial stability of the insured company. This allows the company to significantly mitigate the consequences of losses incurred due to the cessation of production and/or service.

Recently, buildings and equipment have become increasingly sophisticated, making voltage fluctuations more relevant of a risk.

Voltage fluctuations primarily affect sensitive equipment that is connected to the grid or devices that maintain the functionality of the building—such as video surveillance cameras, fire protection systems, and ventilation equipment.

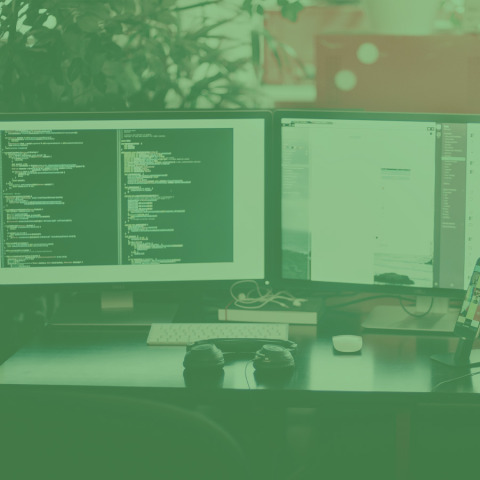

Mobile equipment insurance provides coverage for mobile equipment—various laptops, tablets, mobile phones, and other portable electronic devices.

This category of property is unique because it often requires a broader coverage area (the Republic of Lithuania, Europe, or worldwide).

Internal equipment failure insurance partially extends the warranty period during which the insurance company compensates:

- Repair costs (excluding the replacement of quickly worn-out parts, such as blades, cables, gears);

- Damage caused by foreign objects entering the equipment (for example, a pair of pliers in a machine);

- Damage due to improper handling of the equipment.

consult with an expert?