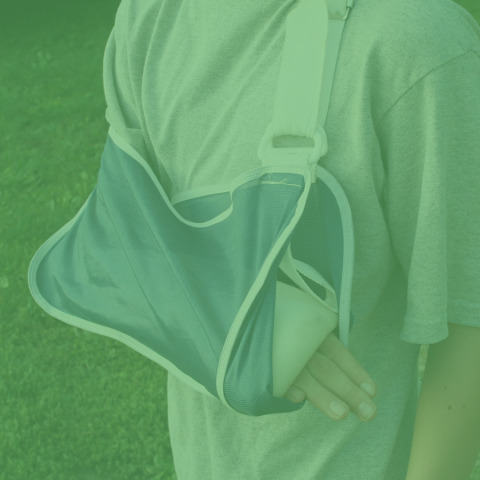

Accidents Insurance

Whom is

Accidents

Insurance for?

Why it is useful to insure with us?

Why it is useful to insure with us?

What we

cover with

Accident

Insurance?

You can choose additional insurance services

The insurance benefit is paid upon the first diagnosis of these diseases:

Insurance benefits are paid upon the first diagnosis of the following illnesses:

- Myocardial infarction;

- Stroke;

- Multiple sclerosis;

- Cancer;

- Other serious illnesses specified in the terms and conditions;

- Other illnesses and surgeries.

Insurance benefits are paid for:

- Dangerous infectious diseases such as legionellosis, trichinosis, the Ebola virus, and meningococcal infection;

- Surgeries for conditions like gastric or duodenal ulcers, acute appendicitis, diphtheria, and post-traumatic osteomyelitis.

In case of an injury, we will additionally reimburse expenses for:

- Medications registered by the State Medicines Control Agency;

- Medical assistance and orthopaedic devices: dressings, splints, sticks, crutches;

- Rental or purchase of wheelchairs and their delivery;

- Diagnostic tests;

- Stitches and dressings for wounds, injections, infusions.

If you choose Assistance insurance coverage, the following expenses will also be reimbursed:

In case of an injury:

- Emergency transportation costs (taxi services);

- Childcare services for minor children.

In case of disability/loss of capacity for work:

- Adaptation of the living space for the insured person with disabilities.

In the event of death:

- Burial/cremation or body transportation expenses;

- Psychological counseling for children, parents, and spouses.

In the event of an injury, sick pay is provided for each day spent at the hospital (up to 180 days for the entire period). Sick pay is provided from the first day of hospitalization.

In the event of an injury, daily allowances are paid for each day of incapacity (up to 180 days for the entire period). A sick leave certificate must be issued for a period longer than 3 days.

If you can no longer work due to injuries and your employment contract is terminated at the employer's initiative, a one-time insurance payment as specified in the insurance contract is made.

Insurance benefits are paid in the event of the insured's death or disability while at work.

Reimbursed expenses include:

- Legal fees (representing the employer or the insured against state institutions);

- Additional occupational safety consultations;

- Communication;

- Burial expenses of the insured;

- Psychological, social, and medical support for the insured's family members for up to 2 months after the insured event;

- Search and training costs for a new employee.

with an expert?